Transform Your Financial Future: Unleash the Power Being Wealthy!

Harness the Magic of Compounding with SIPs: Small Steps Today, Big Rewards Tomorrow!

Who Should Attend This Webinar?

First-Time Investors: Learn how SIPs can help you start your investment journey with minimal risk and maximum growth potential.

Individuals Seeking Financial Freedom: Discover how consistent investing and the power of compounding can transform your financial future.

Anyone Looking to Build Wealth: Understand how SIPs can be your pathway to achieving life goals like buying a home, funding education, or planning for retirement.

Young Professionals: Looking to secure your future? Discover how starting early with SIPs can give you a head start in achieving financial freedom.

...then this is for you!

About us

Mutual Fund Central: Empowering Financial Education

At Mutual Fund Central, we specialize in providing tailored financial solutions and education for the brave personnel of the Indian Armed Forces,Paramilitary Forces

, and civilians since 2021. Our mission is to empower individuals with financial knowledge and guide them in securing their future through services like

Mutual Funds,

Tax Planning,

Child Education Plans,

Health Insurance

Retirement Solutions

and various Financial Services.

Whether you're planning for your family’s future or achieving life goals, we are here to support you every step of the way.

🌟

Mutual Fund Central – Your Partner in Financial Growth.

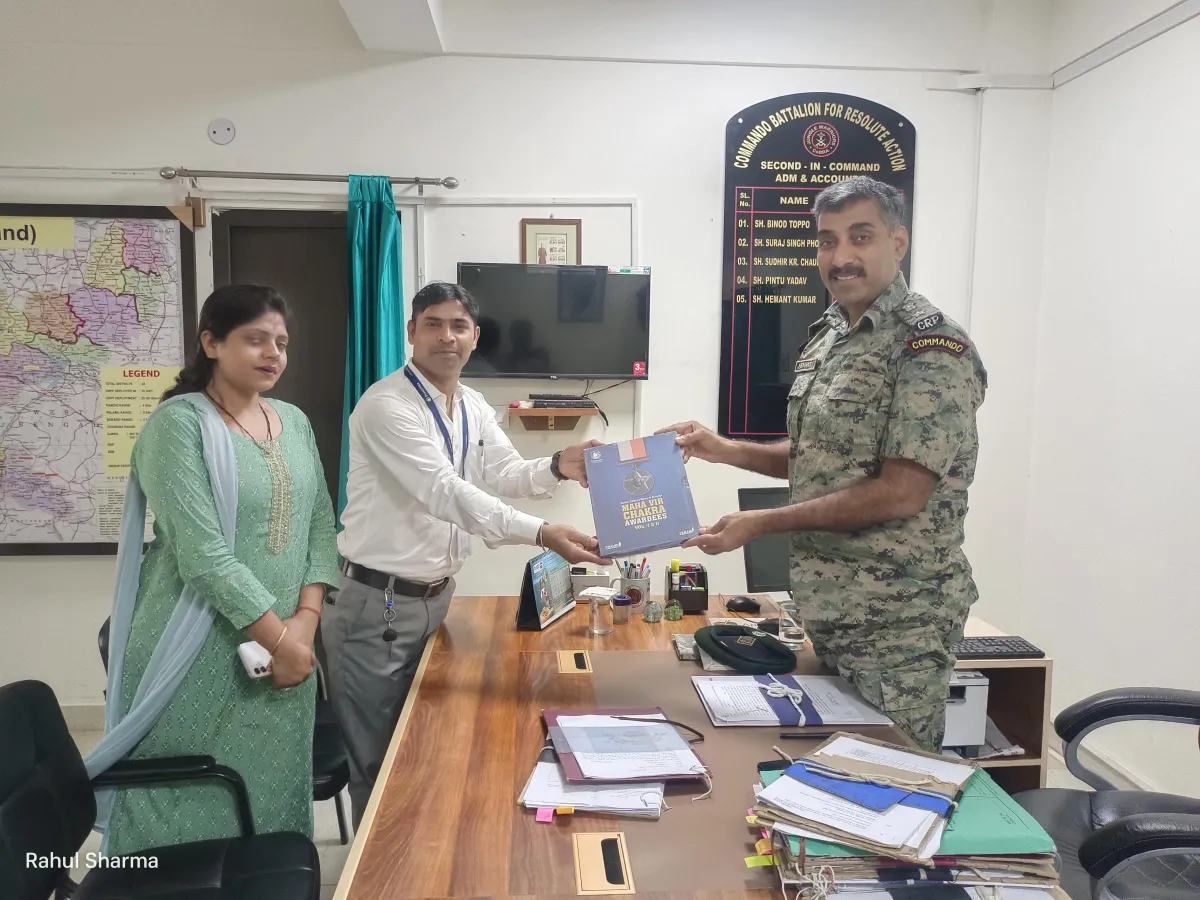

About Rahul Sharma & Team

Financial Educator

Hi, I’m Rahul Sharma, an Investment Banker turned Educator and Financial Planner

with a mission to empower individuals with financial knowledge and help them achieve their life goals. Over the past12 year, I have dedicated my career to guiding people in effectively managing their wealth, achieving strong investment returns, and securing their financial futures.

I take immense pride in having helped 570+ individuals master wealth management and create financial security for themselves and their families. Among my greatest achievements is the creation of 72 millionaires through personalized, strategic financial planning and investment guidance. These success stories inspire me to keep transforming financial dreams into reality every day.

My passion lies in making finance simple and accessible, ensuring that everyone has the tools and knowledge they need to build a secure and prosperous future. Let’s work together to turn your aspirations into achievements and take your financial journey to the next level! 🚀

Our Client Testimonials

Frequently Asked Questions

What is a SIP (Systematic Investment Plan)?

A SIP is a disciplined investment strategy where an investor regularly contributes a fixed amount of money into mutual funds at predetermined intervals, typically monthly. This approach allows investors to invest systematically over time, regardless of market fluctuations, and benefit from the power of rupee-cost averaging.

How does rupee-cost averaging work in SIPs?

Rupee-cost averaging is a key benefit of SIPs. It works by investing a fixed amount of money regularly, regardless of whether the market is up or down. When prices are low, the fixed investment amount buys more units of the mutual fund, and when prices are high, it buys fewer units. Over time, this strategy averages out the cost of units purchased, potentially reducing the impact of market volatility on the overall investment.

What are the key benefits of investing through SIPs?

SIPs offer several benefits, including:Discipline: SIPs instill a disciplined approach to investing by automating regular investments.Rupee-Cost Averaging: SIPs help mitigate the impact of market volatility through rupee-cost averaging.Convenience: SIPs are convenient and flexible, allowing investors to start with small amounts and increase investments gradually.Long-Term Wealth Creation: By investing systematically over time, SIPs can help build wealth for long-term financial goals, such as retirement or education planning.

How do I choose the right SIP for my investment goals?

When selecting SIPs, consider factors such as your investment horizon, risk tolerance, financial goals, and asset allocation strategy. Evaluate the historical performance of SIP funds, fund manager expertise, expense ratios, and investment objectives. Diversify your SIP portfolio across different asset classes, such as equity, debt, and hybrid funds, to manage risk effectively. Regularly review and rebalance your SIP portfolio to ensure it remains aligned with your investment goals and risk profile.

Multual Fund Central, with over 20+ years of experience is a trusted financial Planning spcializing in mutual funds, Portfolio Management Services, Exchange Traded Fund, Equity and insurance. Providing expert guidance for financial success

© 2024 Mutual Fund Central - All Rights Reserved. Privacy Policy